crypto tax calculator canada

You can export all the required forms in under 20 minutes using our platform. Only half your crypto gains are taxed.

Net Income Tax Calculator Manitoba Canada 2020

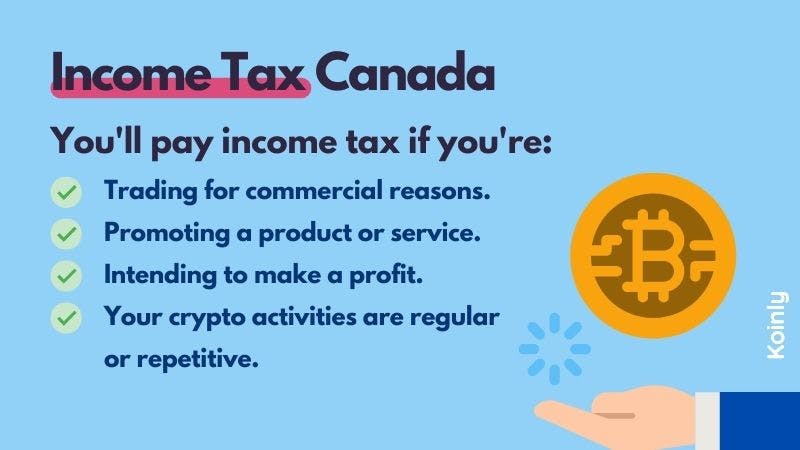

You can use crypto as an investment as a currency for spending or as a source of passive income.

. However it is important to note that only 50 of your capital gains are taxable. The free trial allows you to import data review transactions see a full breakdown of calculated taxes against each transaction and review the dashboard. Koinly is the trusted cryptocurrency tax calculator for Canadian CPAs and accountants.

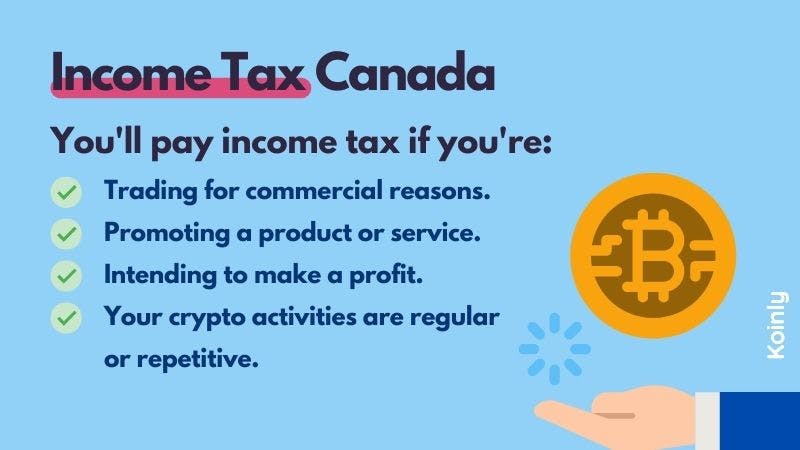

FMV Fair Market Value Cost Basis Capital GainsIncome Fair market value is the amount the asset or crypto is selling for in an independent and fair market. Crypto taxes in Canada are confusing because there are so many use cases for crypto. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity.

What is covered in the free trial. Calculate and report your crypto tax for free now. The Canadian Revenue Agency CRA has published a detailed tax guide for the taxation of cryptocurrencies and digital assets such as bitcoin.

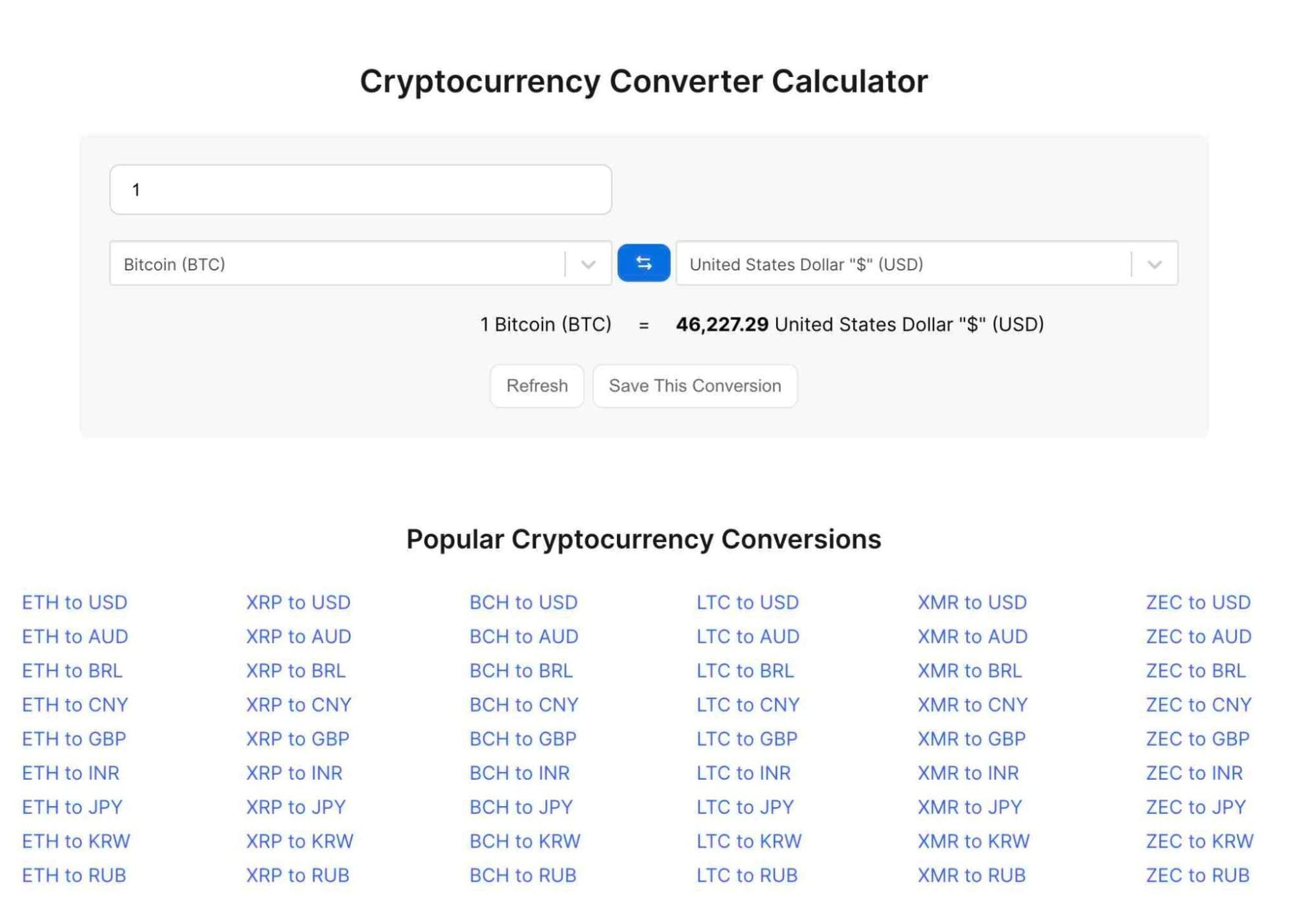

A tool to calculate the capital gains of cryptocurrency assets for Canadian taxes. Heres how you calculate crypto taxes in Canada. Full integration with popular exchanges and wallets in Canada with more jurisdictions to come.

Create your free account now. Whether you used an automated crypto trading app or made the trades. It takes less than a minute to sign up.

Plans Pricing All plans include coverage for every type of crypto transaction including but not limited to DeFi DEXs derivatives and staking as well. The free trial does not have an expiration date. February 12 2022 by haruinvest.

Crypto Tax Calculator. You can discuss tax scenarios with your accountant. However it is important to note that only 50 of your capital gains are taxable.

NFT Support Track all of your NFT trades. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant.

Straightforward UI which you get your crypto taxes done in seconds at no cost. We offer a free trial so you can try out our software and get comfortable with how it works. Coinpanda is a cryptocurrency tax calculator built to simplify and automate the process of calculating your taxes and filing your tax reports.

By sdg team Tax. This concise guide helps you find best crypto calculator Canada 2022 for organising and reporting your crypto earnings to make your life a lot easier. Youll only pay Capital Gains Tax on half your capital gains.

You simply import all your transaction history and export your report. If the charity issued a receipt for the for the current value of 4000 this could be invalidated during an audit. Crypto Tax Calculator.

According to the CRA the charity you donate to can only issue a 600 receipt for your donation and your donation is a disposition. You can calculate this in a couple of different ways but the easiest way is to add up all your capital gains and then halve the amount. Crypto Taxes in Canada.

A simple way to calculate this is to add up all your capital gains and then divide this by 2. Calculate your crypto taxes and learn how you can minimize crypto taxes for the USA UK Canada and Australia. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity.

Supports DeFi NFTs and decentralized exchanges. Youll need to pay Capital Gains Tax on the difference in value so 3600. Ethereum Solana and more.

Filing your taxes is already complicated but it can be more confusing if you have bought or sold cryptocurrency. Sort out your crypto tax nightmare. The best crypto tax tool for Canadian accountants.

Report crypto on your taxes easily using Koinly a crypto tax calculator and software. Home Search results for crypto tax calculator canada How to Calculate Capital Gains on Cryptocurrency. The CRA treats cryptocurrencies similarly to commodities such that the tax implications are that individuals in Canada need to calculate.

Paying taxes on cryptocurrency in Canada doesnt have to be a headache. The adjusted cost base ACB is used to calculate the capital gains. A simple way to calculate this is to add up all your capital gains and then divide this by 2.

The source data comes from a set of trade logs which are provided by the exchanges. Adjusted Cost Base Explained. For income tax purposes cryptocurrency isRead more.

Canada has a few tax breaks that crypto investors will be interested in. 2 Bloor West Suite 1900 Toronto ON M4W 3E2 Canada. Our crypto tax software has helped thousands of accountants and their clients.

1 416 755-3000 USA Office.

How To Calculate Your Crypto Tax In Canada

What Is A Good Rate Of Return On Investments Reverse The Crush In 2022 Investing Investing Money Income Investing

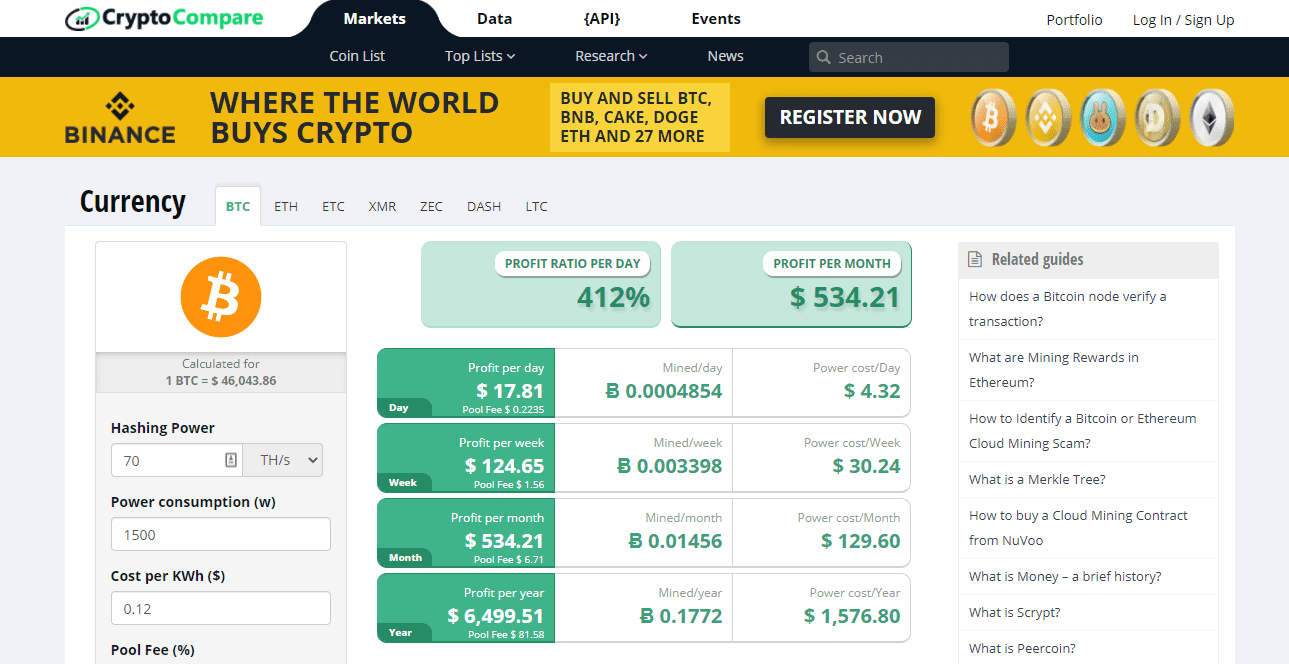

Best Cryptocurrency Calculator Mining Profit Taxes

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Crypto Tax Calculator Overview Youtube

Github Davidosborn Crypto Tax Calculator A Tool To Calculate The Capital Gains Of Cryptocurrency Assets For Canadian Taxes

Paycheck Calculator Oklahoma Hourly 2022 In 2022 Paycheck Ways To Save Money Save Money Fast

Best Cryptocurrency Calculator Mining Profit Taxes

Top 16 Crypto Tax Calculator Tools Startup Stash

Pin On Cryptocurrency Crypto News And Entrepreneurship

Cryptocurrency Taxation In Canada In 2022 Cryptocurrency Capital Assets Goods And Services

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Investment Tracker At A Glance With Cryptocurrencies Nfts Etsy Canada In 2022 Investing Investing For Retirement Google Sheets